Gaining Control Over the Duplicate Payment Issue

Introduction

A key part of any Accounts Payable control structure is the ability to minimize duplicate payments. Even with all the integrated controls of the major ERP systems, companies continue to find it necessary to supplement ERP functionality with other technology solutions and outside audit recovery firms.

Company Experience

During a recent Peeriosity PeercastTM, a Peeriosity member company with over $15 billion USD in annual revenue shared their approach to managing duplicate payments. Their Accounts Payable organization processes 2 million invoices a year with over $8 billion USD in payments to vendors.

The company has a three-pronged approach to controlling duplicate payments, which includes system checks, a duplicate review tool, and an external partner review.

For the system checks, they have configured both SAP and Taulia to check for duplicate invoice numbers and have their team at Capgemini research any suspects. These two systems also have an interface that updates every few minutes and helps to prevent any duplicate invoice entries. Approximately 2,000 duplicate invoices have been detected using these system checks, preventing over $100 million USD in duplicate payments.

The duplicate review tool is an Excel-based macro that works independently of SAP and Taulia to provide another layer of protection. This tool has identified 275 duplicate invoices representing $2 million USD.

The final layer of protection is the use of APEX as an external audit provider to identify any additional duplicate payments that were not prevented by the other internal tools. The most recent results from this effort were an additional eight duplicate invoices detected with a value under $25K USD.

Additional details regarding the efforts of our feature company can be found on the Peeriosity member website, including the Peercast recording and original presentation material.

iPollingTM Results Review

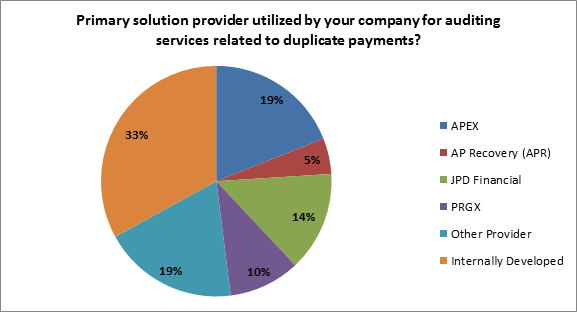

A poll was developed using Peeriosity’s iPollingTM technology in conjunction with this PeercastTM. The first of two poll questions looked at what is the primary solution provider utilized for auditing services related to duplicate payments. The responses are fairly evenly spread across the providers listed on the response key, with APEX (19%), JPD Financial (14%), and PRGX (10%) being some of the most popular. Having an internally developed solution was the most prevalent response, with 33% of the companies taking that approach.

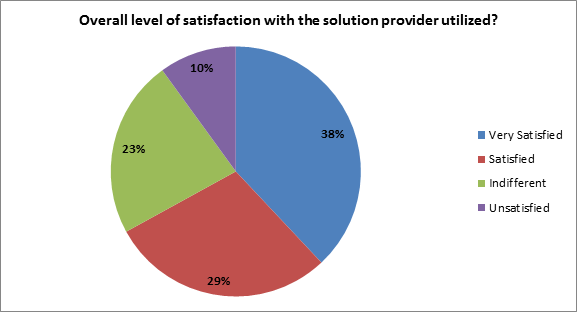

The second poll question then looked at the overall level of satisfaction with the solution providers being utilized, with 38% indicating they are very satisfied and another 29% saying they are satisfied. An additional 23% are indifferent regarding their service provider, while 10% are unsatisfied.

Some of the comments made by Peeriosity members in conjunction with this poll include the following:

Retail Member: We have an in-house solution. Periodically, we use APR to review our full details to confirm our in-house solution is still relevant. Have been pleased with APR when we have used them in the past.

Real Estate & Construction Member: Our ERP has a duplicate invoice check, but it is very ineffective. I’m looking for a tool to utilize to prevent duplicates prior to payment.

Consumer Products & Services Member: Rather than using an audit service performed every six months, our company uses a product called DataShark provided by Technology Insight (TI). Our AP data is sent to TI at the end of each month. The DataShark algorithm identifies potential duplicates and assigns a confidence level (90%/75%/50%/25%) that the finding is valid. Our AP team performs the research on these items and documents the results in the tool.

Non-Profit Member: We utilize ATS, Audit Technology Services.

Agriculture & Mining Member: We use an internally developed tool. We will shortly be conducting an AP transaction audit via a 3rd party – will be interesting to see what they find that the internal tool didn’t pick up.

Consumer Products & Services Member: APEX is our 3rd party Auditor for duplicate and overpayments.

Manufacturing Member: AP does the initial payment review using queries from our payables system. The data is available for PRGX to review 30 days after the payment is made.

Non-Profit Member: We developed a small utility in Excel which looks at all payments in the last 6 months. According to the intelligence built-in in the code, it flags out potential duplicates. The process automatically sends an e-mail to the payment requesters so they can confirm if it is a false positive or an actual duplicate.

Manufacturing Member: We utilize PRGX and are very satisfied with the results they’ve delivered.

Closing Summary

The ability of companies to gain significant control over duplicate payments has improved significantly over the past several years as technology in this area continues to become more sophisticated. As demonstrated by our feature company, when this technology is applied with multiple levels of control, including the use of a third-party external solution provider, the likelihood of duplicate payment to avoid detection can be significantly reduced.

What is the status of your company with respect to controls related to duplicate payment mitigation? Does your current approach achieve the desired result or is it time to take another look at this important aspect of Accounts Payable?

Who are your peers and how are you collaborating with them?

______________________________________________________________________________

“PeercastsTM” are private, professionally facilitated webcasts that feature leading member company experiences on specific topics as a catalyst for broader discussion. Access is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from attending or accessing discussion content. Members can see who is registered to attend in advance, with discussion recordings, supporting polls, and presentation materials online and available whenever convenient for the member. Using Peeriosity’s integrated email system, Peer MailTM, attendees can easily communicate at any time with other attending peers by selecting them from the list of registered attendees.

“iPollingTM” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated email system, Peer MailTM, members can easily communicate at any time with others who participated in iPollingTM. Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here