Using Process Discovery Software in Intelligent Automation

Introduction

For Intelligent Automation projects, and specifically, Robotic Process Automation (RPA), where the go/no go threshold is significantly lower due to low implementation costs and short project timelines, creating a prioritized list of project candidates can become a challenge since the process owner’s and process expert’s gut-feel based on where they see opportunities may not be aligned with actual volumes and time requirements to complete process steps. The most mentally frustrating or repetitive work processes will be at the top of the list when, in fact, other less obvious work processes might be significantly better candidates.

With the rise of Intelligent Automation solutions, there is also a range of supporting solutions, either as add-on components from an IA software provider or as separate software solutions that are specifically focused on process mining or process discovery. While Intelligent Automation has been quickly proven to have merit, using tools, including software solutions, to identify opportunities is a new opportunity where the track record for success is less clear.

iPollingTM Results Review

Recently, Peeriosity’s iPollingTM was used by a Director of Shared Services at a member company to better understand how peers are identifying Intelligent Automation project opportunities. Using this approach, the poll author was able to quickly gain insights into his issue, which he described as follows:

In order to justify Robotic Process Automation (RPA) costs our company would like to identify processes where the benefits of automation outweigh the costs. Using a tool to identify those processes where the highest volume or longest delays are occurring would expedite the selection process. We are interested to know what other Peeriosity member companies are doing in this area.

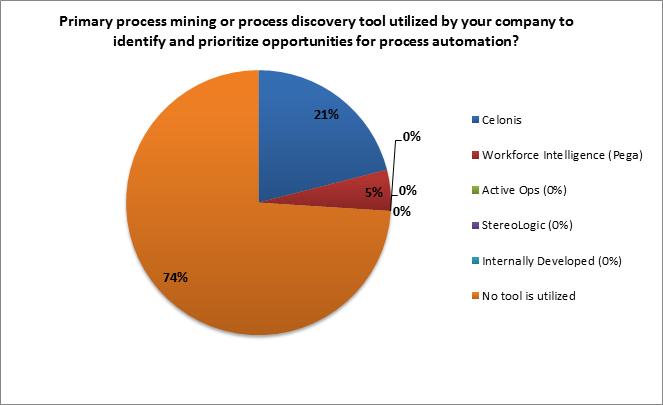

The first question in the poll asked about the tool that is being used. As expected, this opportunity is so new that most companies are not using a tool, with 74% selecting this response. For those that are, 21% are using Celonis and 5% are using Workforce Intelligence (from Pega), with zero percent using Active Ops, StereoLogic, or an internally developed solution.

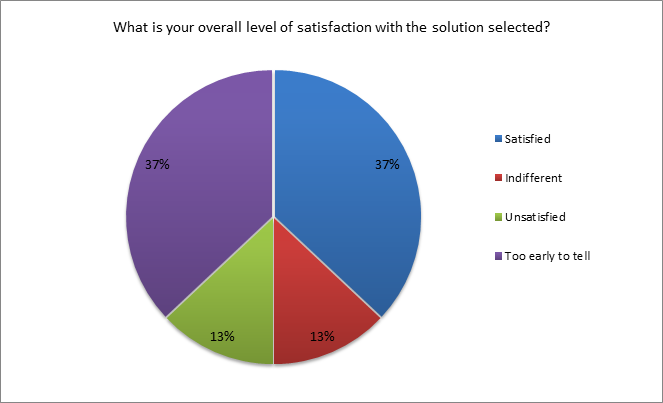

Regarding overall satisfaction levels for the vendor selected for companies who are using a tool for process mining or process discovery, 37% report being satisfied, and for the balance of 63% the responses range from “Too early to tell”, to Unsatisfied or Indifferent. Here are the details:

Here are several of the comments added by members:

- It sounds like your purpose in using process mining is certainly valid. Unfortunately, this isn’t something we’ve utilized yet, but we are open to using it and hopefully will be within the next year or so.

- We are at the beginning stages of Process Mining. Currently implementing for the P2P workstream.

- We are not currently using a process mining platform, but your use case makes sense. From what I have understood Celonis is considered to be best-of-breed currently.

- Unfortunately, we don’t have a tool that can help us to identify automation opportunities.

- We have purchased Celonis but have delayed implementation until after we complete our S/4 HANA upgrade.

Closing Summary

Making the decision to implement Intelligent Automation Solution(s) is straightforward and easy, but navigating the myriad of other related choices and options can be overwhelming. Considered “leading edge” only a few years ago, Intelligent Automation has quickly proven itself to be a quick win, with virtually all companies moving to implement. When it comes to related solutions to identify which opportunities have the largest and quickest payback, the path forward isn’t as clear. While you want to stay leading-edge, how do you avoid the consequences of making a bad guess? Fortunately, with many companies having deep experience in this area, Peeriosity member companies can easily learn about and, more importantly, understand the reasons peer companies are making various selections. Understanding the paths taken by trusted peers can be invaluable as companies determine their own optimal path to follow.

What approach does your company take to using a process mining or process discovery tool to identify and prioritize opportunities for process automation? If you are using a tool, how satisfied are you with the solution you selected?

Who are your peers and how are you collaborating with them?

______________________________________________________________________________

“iPollingTM” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated email system, Peer MailTM, members can easily communicate at any time with others who participated in iPolling.

Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here.