Account Reconciliation Process – Automation Delivers Efficiency and Opportunity

One of the most important activities of every organization is the timely and accurate reconciliation of general ledger accounts. Early identification of accounting and control issues is critical for any number of reasons, especially for public companies. Most companies have ongoing efforts to continuously improve the reconciliation process with the objectives of pro-active early identification of issues, optimized efficiency of the process, and enhanced controls.

A recent webcast within the General Accounting research area of Peeriosity featured a member company that has realized significant gains in each of these objectives through efforts coordinated by their Global Shared Services Organization. This was accomplished through standardization of the reconciliation process, automation, division of work, and reporting.

The webcast feature company is a large multinational with reconciliation challenges that include statutory and currency requirements related to the almost 100 countries in which they operate. Their initial objective was the daunting task to standardize the reconciliation process globally for all accounts. This was assigned to the Process Management team within Shared Services with an assigned process owner for all balance sheet accounts. The team is well versed and trained in Business Process Management (“BPM”) methodologies and took a disciplined approach to determine the way forward.

One of the first steps was a review of the accounts in use to determine:

- What the account used for

- Who reconciles and how often

- Who analyzes

- Manual vs. automated percentage of entries

- Risk Assessment

Simultaneously global standards were determined that included the requirements for sub-ledgers, analytic capability, and categorization of reconciling items (e.g. P&L impact, misclassifications). Additionally, it was determined that the centralized oversight owner would be the Process Management organization within Shared Services, with the execution of reconciliations to be carried out by the regional Shared Services centers.

The next step after determining the requirements and defining the activities was to find a way of making the process more efficient. A number of enabling technologies were reviewed and a third-party account reconciliation tool was chosen and implemented.

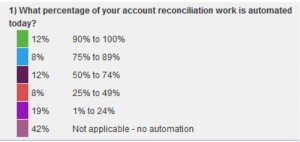

A poll of Peeriosity members was taken to determine how prevalent the use of automation tools in the reconciliation process was in their organizations and the results indicated that there are still some significant gains to be made as 42% of respondents do not currently have an automation enabler. Additionally, just 20% of the responding companies indicated that they currently have at least 75% of their reconciliations automated.

Our feature company indicated that they currently have approximately 75% of their account reconciliation work automated and believe that, for them, this is the appropriate percentage based upon their analysis and risk assessment of accounts. Their criteria for automation included a high volume of entries generated from transactions processed via their ERP, as well as a relatively low-risk rating assigned to the account.

80% of the poll respondents who have automated indicated moderate to significant improvement in the overall reconciliation process. Our feature company indicated that they are extremely satisfied with the outcome as it has allowed them to shift company resources away from reconciling three-quarters of the accounts to higher-value activities associated with analytics, decision support, and reporting.

Post standardization and automation, a further division of work was assigned with centralized oversight provided by the Global Shared Services organization. The Process Management team in Shared Services now had greater visibility to accounts and shift resources from reconciling to reporting, risk identification, and critical analysis. Additionally, they perform quality review audits of the entire process, looking for ways to improve, as well as a manual review of accounts and entries that have been identified as higher risk or meet a specific dollar threshold. The entire reconciliation process is highly visible and monitored in real-time with a dashboard that is part of the automated tool.

The results for our feature company have been excellent. Accomplishments include;

- Improved efficiency – Automated 75% of the reconciliation process

- Clear identification of account ownership for reconciliation and analysis

- Shifted resources from low-value reconciliations to high-value analytics and decision support, reporting, and risk identification activities

- Improved Controls – Fewer issues and pro-active identification of unusual items

- Real-time monitoring of activities across the entire process and all centers

- The ongoing process for improvement

What is your company doing to improve the account reconciliation process?

Who are your peers and how are you collaborating with them?