Streamlining the Goods Receipt/Invoice Receipt Process

Introduction

Nothing is more fundamental in Accounts Payable then the 3-way match process. While many also leverage a 2-way match process using Pay-on-Receipt or Evaluated Receipts Settlement, many transactions continue to be processed by matching the invoice with the receipt and the purchase order. When price and/or quantity discrepancies are not resolved in a timely manner it creates a range of accounting issues and vendor management issues.

For many companies, a GR/IR report is a critical tool for identifying and resolving discrepancies in Goods Receipts (GRs) and Invoice Receipts (IRs). These discrepancies can lead to inaccurate financial reporting and potential liabilities. By using the GR/IR report, companies can streamline their clearing process, improve efficiency, and ensure accurate financial records. This report is particularly useful for addressing aged, open items. By identifying these discrepancies early, companies can take corrective actions to avoid potential financial issues.

Company Experience

A Peercast discussion in Peeriosity-100’s Accounts Payable (P2P) research area featured a global company with $20B in annual revenue discussing their efforts to streamline the Goods Receipt/Invoice Receipt (GR/IR) process. The year-long project involved analysis, understanding, communication, and participation with all of the various touchpoints in the process to identify disconnects, establish accountability, and provide user training.

The GR/IR report details purchases in transit and unbilled payables. The GR value is the total dollar value of the goods or services receipt that is entered by the Purchase Order (PO) initiator or the Receiving department. The IR value is the dollar value of the goods or services receipt entered in Accounts Payable that have either been invoice or paid. Open GRIR then is when either the invoice or receipt record have not been entered or there is a mismatch in value due to either price or quantity differences.

The original process was to create an open IR/GR report of items over 90 days and send the reports to the PO initiator (the buyer for inventory purchases, and the requester for non-inventory) for review and action, which might include reversing the receipt, or keeping it open and following up with the vendor for resolution. After collecting all of the replies the report was sent to Finance for review.

The challenges with this approach included buyers and PO initiators who were non-responsive despite multiple follow-ups and escalations. Resolving discrepancies over 90 days wasn’t considered a priority that should take precedence over current and perceived more important issues. There was no local authority with someone in a senior position locally who could provide pressure and encouragement for the review and resolution to be completed timely and accurately. There were also no decision-making rights in Accounts Payable.

The solution implemented included setting new dollar thresholds for write-offs and providing training for internal teams with responsibility to resolve the discrepancies. In addition, the company implemented quarterly reporting to local Finance Directors on items pending over 150 days, providing them with visibility to the issues and the responsible parties for follow-up and resolution. They also created a process where Finance Directors were authorized to close outstanding items, further reducing the number of aged items.

The results were significant, with open items greater than 180 days reduced by over 50% within six months of the process redesign.

Polling Results Review

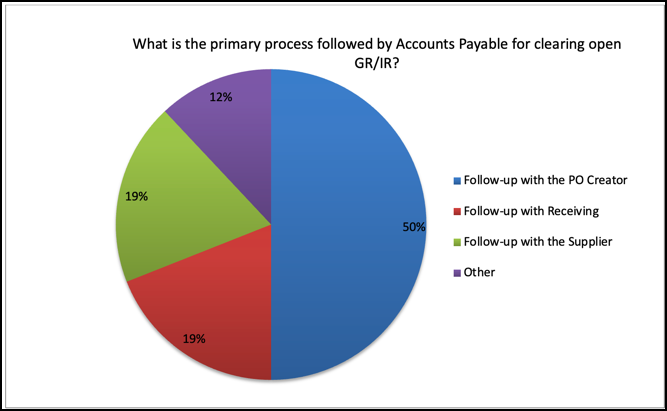

A poll was created by the member featured on this Peercast to better understand the process Peeriosity-100 member companies follow for clearing open GR/IR. The poll results were important inputs to decisions that were made to streamline the GR/IR process. For 50% of responding companies, the primary process is to follow up with the PO Creator. 19% primarily follow up with the Supplier, 19% primarily follow up with Receiving, and the balance of 17% use another approach including differing completely to Purchasing to resolve.

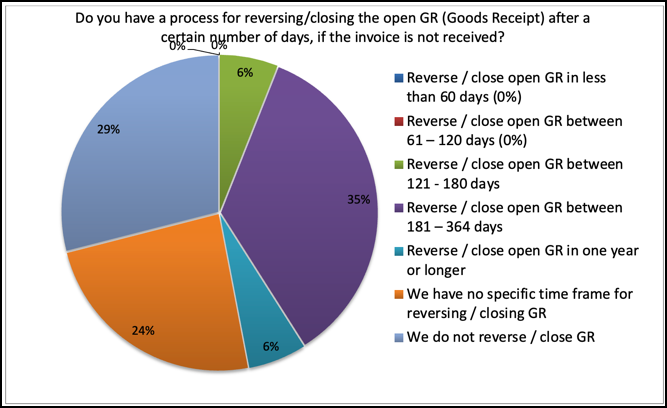

The second question in the poll asked about the process for reversing or closing open Goods Receipt (GR) after a certain number of days if the invoice is not received. No company indicated they make this decision prior to 120 days. 6% reverse/close between 121 -180 days, 35% reverse/close between 181 and 364 days, 6% reverse/close after one year, 24% have no specific time frame, and 29% do not reverse/close Goods Receipt because the open items over a certain threshold are fully resolved by some combination of efforts between the supplier, AP, Purchasing and/or Receiving.

Here are some of the comments from Peeriosity-100 members:

- It is the responsibility of the requestor of the service and Procurement, not AP team to manage the vendors and make sure all invoices are received. They also need to manage their purchase orders through the process. Regarding Policy, we have a policy to clear all GRIR mismatches at 270 days. AP clears the transactions for non-inventory PO’s using MR11 in SAP. Supply Chain manages the Inventory related PO’s as there is an extra step related to inventory after the clearing is completed. If an invoice comes in after the clearing is done, it is posted as a subsequent debit on the PO. The clearing isn’t reversed.

- AP does not close out open GRs. The receivers have to reverse them once they are notified by the supplier that there are no outstanding invoices.

- We only follow up greater than a set dollar amount, anything lower at the ageing date will be written off.

- We currently followed up with PO creator. We would like to move this responsibility to AP.

- The GR/IR Report shows the open Goods Receipt (GR) under a Purchase Order, where no invoice has been received OR there is a discrepancy in quantity (GR quantity is more than the invoice quantity). AP is doing a monthly analysis to clear the balances. Low value balances are written off after 150 days, the threshold is around 250 Euro for European counties and $5K for the US. All balances need to be cleared above the threshold. AP is contacting the supplier and asks for balance confirmation /statement and AP needs to ensure that all invoices are processed in AP, if the receiving is missing then AP is gathering the shipment documents and with the document they are going back to the requestor and ask for a receipt.

Closing Summary

Clearing the books for discrepancies identified in the GR/IR process isn’t the most glamorous process, because it requires a look back of many months to resolve discrepancies that are still outstanding. For our Peercast feature company, streamlining the process involved a mix of techniques, including setting appropriate materiality thresholds, and most importantly educating all interested parties in their responsibilities. The education efforts are further reinforced by having local Finance leadership who can exert pressure and ensure appropriate accountability.

What is the GR/IR clearing process at your company? How satisfied are you with the current process, and when was this process last evaluated to identify improvement opportunities?

Who are your peers and how are you collaborating with them?

_____________________________________________________________________________

“Peercasts” are private, professionally facilitated webcasts that feature leading member company experiences on specific topics as a catalyst for broader discussion. Access is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from attending or accessing discussion content. Members can see who is registered to attend in advance, with discussion recordings, supporting polls, and presentation materials online and available whenever convenient for the member. Using Peeriosity-100’s integrated email system, Peer Mail, attendees can easily communicate at any time with other attending peers by selecting them from the list of registered attendees.

“Polling” is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity-100’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in Polling.