Processing Payment Requests with No Invoice

Introduction

For vendors and suppliers to get paid, there typically is a process for submitting invoice information that details what was purchased and where to remit payment, plus other details like an invoice number, purchase order number, and payment terms, to facilitate the invoice being approved and processed. Transactions without invoices are also likely at many companies, often based on either a Pay on Receipt or an Evaluated Receipts Settlement process, where payment is made per the terms on the purchase order, with the receipt of the items purchased triggering the payment. Another type of payment without an invoice is for utility payments, which are made based on a statement and not an invoice; although the process is similar to payments made from the statement with reference to a purchase order or approving department. Transactions that are less frequent, but also normal are payments to entities that do not supply an invoice of any kind, including corporate tax payments, donations, and grants.

iPolling Results Review

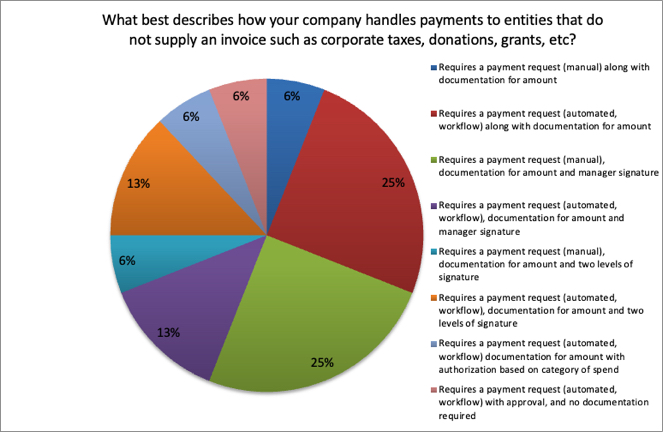

A recent Peeriosity poll submitted by the Invoice to Pay Lead at a large global company asked about the approaches used by Peeriosity member companies to process payment requests with no associated invoice. As described by the member creating the poll, “we are interested in understanding how other members handle payments that are made less frequently to entities that do not supply an invoice. Examples would be corporate taxes, donations, grants, etc.”.

The poll results indicate that 6% of the members follow a process that requires a payment request (manual) with supporting documentation, with 25% requiring a payment request (automated, workflow) with supporting documentation. An additional 25% require a payment request (manual) with supporting documentation and a manager’s signature, with 13% requiring a payment request (automated, workflow) along with supporting documentation and a manager’s signature. 19% follow a similar process that requires two signatures. For 6% the authorization is based on the category of spend, and for 6% no documentation is required. Here are the details:

A few of the comments from members include:

- Non-PO Vendors follow this offline approach to get approvals and request payments based on supporting documentation.

- We use a template cover sheet that includes the relevant information. The backup document -request for payment is the backup page. It is submitted thru the scanning process and approved in the tool. In our process sponsorships, donations require preapproval in concur and a purchase order submitted.

- We use Coupa payment requests and approval workflow thru Coupa.

- Signed forms and documentation are submitted to the AP team through email and are converted to an electronic file which is indexed and posted by the AP team.

- Nintex workflow.

- We have a tool called NIP or non-invoice payment, developed out of SAP workflow functionality. We are also looking at alternatives after 15 years of usage.

- Requires a request to be entered through an internally developed tool that requires a copy of the invoice and specific authorization based on the category of spend and level of the signer.

- I chose other on this since documentation is not required. The request is submitted using an internal AP Voucher in excel format. The voucher is submitted into our workflow solution (Tungsten) where the appropriate approvals are gathered.

Closing Summary

Having clear and defined processes for preparing, approving, and entering transactions in Accounts Payable is important to ensuring accuracy and efficiency with an appropriate emphasis on business controls. While most transactions require an invoice as supporting documentation, there are instances where the entity receiving payment does not generate an invoice or an account statement. Designing a clear and appropriate process for these types of transactions is easier when you have direct access to the approaches used at leading peer companies, with the ability to contact and discuss specifics for your design directly with peers.

How does your company handle payments to entities that do not supply and invoice? What tools do you use to process the transactions and how automated is the process?

Who are your peers and how are you collaborating with them?

________________________________________________________________________

“iPolling” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in iPolling.

Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here.