Fraud Control using Oversight’s Risk Mitigation Solutions

Introduction

The risk of fraudulent transactions continues to impact the ability of companies to expand the distribution and allowable usage of both the Purchasing Card and the Travel Card. While the appropriate use of merchant category codes (MCCs) and monetary limits are cornerstones of any card fraud prevention structure, in recent years new tactics and technologies have been developed that can help to mitigate these risks when implemented and administered properly. Some of these solutions have been developed by software solution providers, while others are being developed within companies to address their own specific requirements.

Company Experience

A recent Peeriosity PeercastTM featured a large global company with over $50B in annual revenue discussing their experience with using Oversight Systems software’s risk mitigation solutions to reduce the risk of Corporate Card fraud. With a project that was implemented in 2020, the project’s mission was to transform the travel and expense and purchasing card process by leveraging technology to focus on high-risk areas and transactions without sacrificing accuracy, internal controls, or compliance with corporate policies. Implemented for their North American Finance Shared Services Center, the project scope included 30+ business units in the US and Canada with over 5,000 active Corporate Card accounts with roughly 100,000 expense reports and over USD $100 million in credit card spending. The company uses a One Card program for Travel and Entertainment and for Purchasing Card transactions, using Concur as the expense reporting platform.

The company’s history includes the implementation of Concur in 2010, the implementation of Concur Paperless Pay and transition to a One-Card program in 2017, the implementation of reason codes for exceptions in SAP Concur in 2018, and most recently the launch of a project to utilize software and Artificial Intelligence technology in 2019, with the project completed and implemented using new processes and technology in 2020.

Some of the benefits of implementing Oversight Systems software discussed by our feature company included:

- Quick identification of high-risk transactions

- Pre-built analytics based on best practices and industry data

- Visibility to repeat offenders

- Case management enabled workflow to support root-cause tracking

- Reduction of overall operating cost by more than $250,000 per year

For details, Peeriosity members are encouraged to sign into the member’s area to view the complete presentation and listen to the recorded Peercast.

iPollingTM Results Review

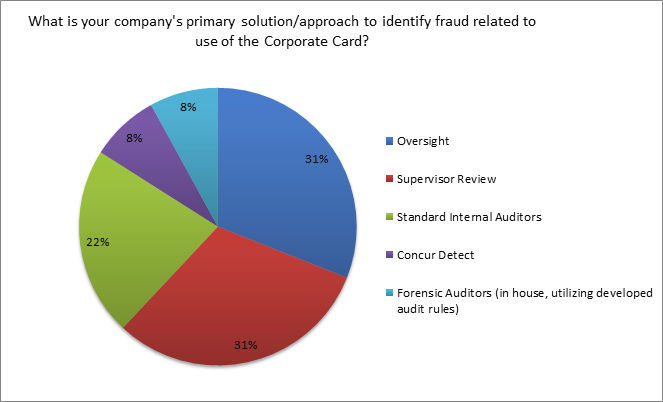

The results from a recent Peeriosity poll created using the iPollingTM technology provide additional insight into this topic. The first question in the poll asked Peeriosity member companies about the primary solution/approach they were using to identify fraud related to the use of their Corporate Card. The results indicate that 31% are using Oversight Systems software, with an additional 31% at the other end of the spectrum and relying on supervisor review. An additional 22% indicate that review by Internal Auditors is the primary solution/approach, with 8% relying on Concur Detect and 8% relying on Forensic Auditors.

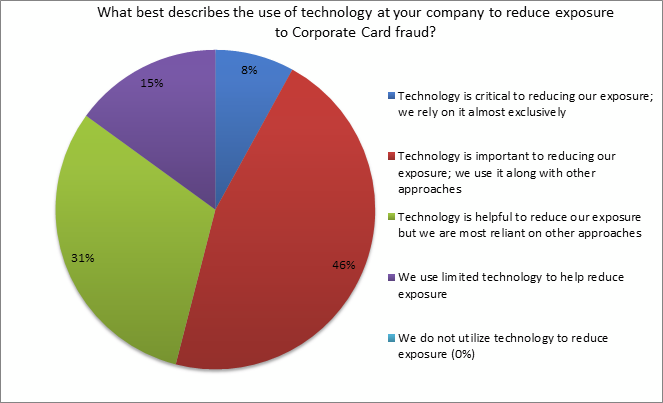

The second poll question asked about the use of technology to reduce exposure to corporate card fraud. While only 8% indicated that they rely on technology almost exclusively, 46% report that technology is important to reducing exposure, and is used along with other approaches, with 31% indicating that technology is helpful but that they mostly rely on other approaches. The remaining 15% indicated that their use of technology is limited as a means to help reduce exposure to corporate card fraud.

A few of the comments from members include:

- We utilize Concur alerts, manual audit with specified criteria for audit, and the fact transaction review. Corporate card provider also assesses and declines fraudulent transactions and disable credit card.

- We use an Oversight analytics tool to help us focus on potential issues as part of an after-the-fact review.

- Our primary solution is Concur Detect but our process also incorporates additional system checks within Concur along with supervisor review and approval prior to reports being approved for payment.

- We use Oversight and we have monthly updates with Steering Committee.

- Manager Review is our primary detection; however, we also have other tools we leverage, including Concur Detect. However, since the manager is closest to the spending and knows the details of the employees’ travel, spending, etc., they are the primary control.

Closing Summary

The concern with card fraud is that companies can develop a false sense of security that their existing systems and controls are more than adequate, while, in actuality, there could be a significant control breach that they are not even aware of. With a large number of cardholders and high monetary amounts of transactions flowing through the typical Travel Expense and Purchasing Card program, comes the need to continually upgrade the capabilities of the fraud detection systems and controls to mitigate the exposure that the company faces. A nominal investment in new tools might save many companies a significant amount of money by allowing them to better detect and control fraud.

Is your company leveraging the latest technology to keep Corporate Card fraud to a minimum? How confident are you regarding the integrity of your card program?

Who are your peers and how are you collaborating with them?

______________________________________________________________________________

“PeercastsTM” are private, professionally facilitated webcasts that feature leading member company experiences on specific topics as a catalyst for broader discussion. Access is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from attending or accessing discussion content. Members can see who is registered to attend in advance, with discussion recordings, supporting polls, and presentation materials online and available whenever convenient for the member. Using Peeriosity’s integrated email system, Peer MailTM, attendees can easily communicate at any time with other attending peers by selecting them from the list of registered attendees.

“iPollingTM” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity’s integrated email system, Peer MailTM, members can easily communicate at any time with others who participated in iPollingTM.

Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here.