Sourcing Shared Services – Captives with Selective Outsourcing Gaining

Only a few years ago, it seemed that leaders of Shared Services used to debate the merits of being a “captive” versus “outsourcing” as if it was an either/or decision. The discussion quickly started to include more terms, like nearshore and offshore, that related to both captive and outsourced. To further the matrix of options, studies were published evaluating various locations where these centers could be located that included estimates of labor costs and projected escalation, as well as some evaluation of skilled labor among other variables. This was always couched as “strategic sourcing decisions” critical to Shared Services.

A few months ago, we noticed the sourcing-related collaboration discussions taking place peer-to-peer within Peeriosity were related to tactics to best deliver services and not part of some over-arching strategy to be a “captive” or “outsourced”. In fact, the key strategic discussions that involved sourcing tended to be best-practice structures to ensure ongoing improvement and evolution across the functional silos in end-to-end processes – which tended to have multiple providers of activities within the process.

In other words, it is now a given that there may be multiple providers (internal and external) to deliver Shared Services – and regardless – it is up to Shared Services to maintain ownership over their services and deliver on the promise of Shared Services.

Shared Services leaders have always been tasked with the objectives of reducing costs, enhancing controls, and improving service delivery as means of providing ever-increasing value to the enterprise. How those services are sourced given expanding service scope and geographic landscape is usually left as a decision for Shared Services. The Shared Services leader must add to his skill set the ability to evaluate and choose sourcing options, which may vary for service and region. For instance, mature well-evolved transactional services may be provided by a third-party outsourcer while business decision support services may be provided by the “home region” captive center.

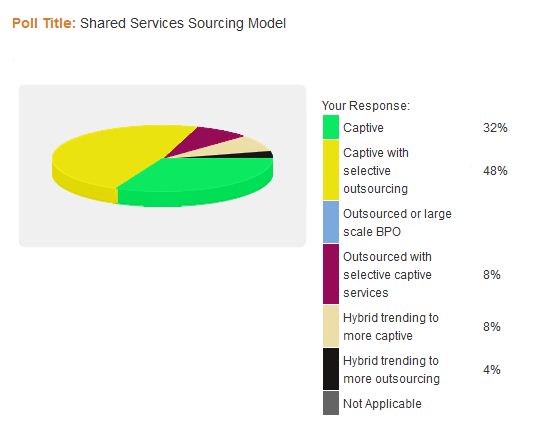

A recent poll of Peeriosity member companies indicated that 48% would now describe themselves as “Captives with Selective Outsourcing”, while 32% considered themselves “Captives”. However, in both instances, many of their services were being provided by either offshore or nearshore centers staffed with company employees. In almost all instances, all sourcing options are on the table and revisited on a regular basis.

Many Shared Services organizations are leveraging their company’s global workforce and locations to develop their captive service capabilities as an alternative to outsourcing. According to recent research by the Everest Group “…the (captive offshore or nearshore) model is different from third-party models and that is not widely understood. A captive can not only deliver the typical services of a (third-party) service provider, but also many other services which are part of the normal business. In effect, it (a captive center) is a corporate campus which happens to be based offshore.”

Eric Simonson, Everest Group’s managing director goes on to say “The value may be in terms of ability to ramp up and down resources for ad-hoc needs, create new ideas that advance the status quo, contribute talent to the global leadership of an organization, or provide an option to enter or better serve new geographic markets. Success increasingly becomes about the impact the captive has on the broader organization, not just the cost of the process or activity.”

The good news is that there are more sourcing options available for Shared Services leaders today than there were a few years ago. A new Shared Services organization open to the options can quickly achieve the success of a highly mature center. However, it’s not an all-or-nothing sourcing choice. Some key considerations (in addition to cost) include:

- Process Ownership, Governance, and Evolution Flexibility

- Maturity of Process or Activity

- Geographic Scope

- Language

- Service Delivery Style and Channels

- Customer Impact

- Change Capability

- Risk and Control Assessment

- Scalability

- Workforce Assessment (skills, costs, availability, etc.)

There are many extremely capable research and consulting firms that can assist with these sourcing evaluations. One of the best sources of insights on sourcing options, as well as all aspects of operating Shared Services, come from peers who have actually made similar decisions and are accountable for delivering value to their customers every day – they are living with the consequences of those decisions. Peeriosity members immediately access the knowledge and experience of their peers in evaluating these sourcing choices.

How is your company assessing your service delivery sourcing options?

Who are your peers and how are you collaborating with them?