Accounts Payable and the Paper Check Problem

Introduction

Since the 1980s, when considering improvements to the Accounts Payable process, companies around the world successfully deployed solutions that evaluate Accounts Payable as one component of the Procure-to-Pay process. This yielded improved efficiencies between functional areas, and often eliminated the need for invoices entirely with pay-on-receipt processes. However, when it comes to making the payment, while the global norm is 100% electronic, for many in the United States printing and mailing paper checks continues as a common method for how payments are processed.

Polling Results Review

A poll created by the Accounts Payable Global Process Owner at a Peeriosity-100 member company provides insight into the issue of paper checks. While the company creating the poll has been successful in transitioning many payments to be electronic, the company is still processing 6% to 15% of their payments using paper checks. The poll looked at the volume of payments made by paper checks; and when paper checks are used, where they are printed.

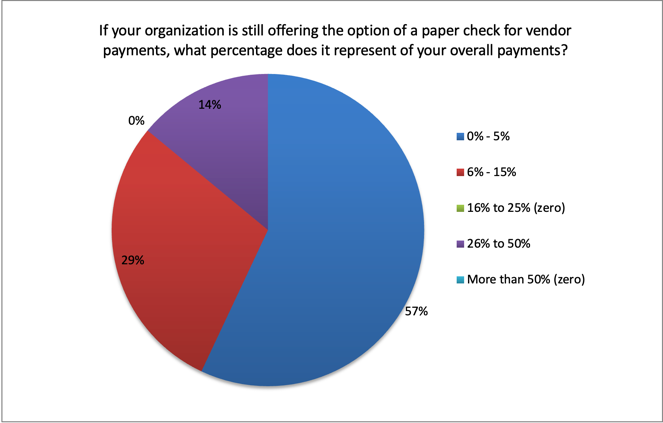

The good news is that compared to a similar poll in 2018 where only 30% of reporting companies have more than 80% of their U.S. payments made electronically, that amount is now significantly higher with 86% reporting that electronic payments are used more than 85% of the time. As detailed below, 57% of companies have less than 5% of their payment by check and an additional 29% have between 6% and 15% of their payment made by check. The remaining 14% are between 26% and 50%, with no company reporting over 50% of their payments by paper check.

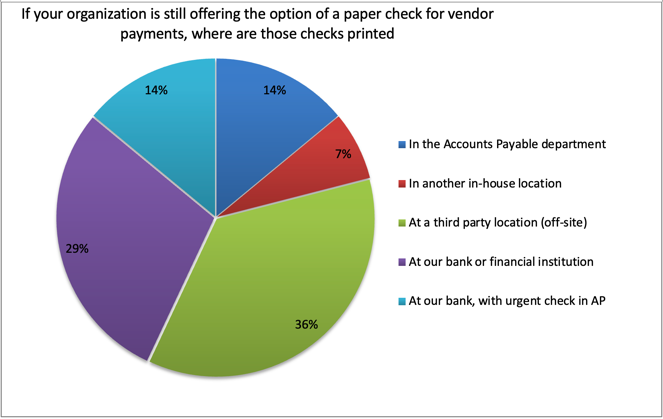

When paper checks are required, 43% of responding Peeriosity-100 member companies have them printed by their bank or financial institution, and 36% have them printed by a third party at an off-site location. Only 21% have checks printed in Accounts Payable or in another in-house location.

Here are a few of the comments from Peeriosity members related to this poll:

- If we need to print checks, most are sent to our bank to print for us; however, there are times when the Accounts Payable team needs to print them locally from the office (for example, a check that needs to go via overnight delivery to a law firm).

- Most of our paper checks are printed at our bank. However, we do have the ability to print checks in our local office as well and do so on an as needed basis.

- We still do have the opportunity to print immediate checks locally in our headquarters and shared service offices. Many of our checks are refunds and or utility payments. This is a priority for 2026 to reduce the check count. Postage rates continue to rise and this hurts the bottom line.

- Checks are only available to legal settlements (if wires are not accepted) and customer refunds.

- We have few checks and continue to discourage this form of payment. For the small volume we do have, we leverage a service from our bank.

Closing Summary

While making payments by check isn’t necessarily a broken process, since the U.S. Postal Services is highly automated and reliable for the delivery of machine generated checks, the process takes time, typically two to three days in transit, and is costly. Even though the benefits of electronic payments can be significant for both the company and their suppliers, for U.S. related payments, challenges remain with 33% of member companies having 6% or more of their payments using paper checks. The good news is that companies continue to make progress, in part by increasingly mandating compliance with suppliers, where possible.

What is your ACH rate for U.S. payments? Do you mandate? What options are you considering for reducing paper checks for U.S. based payments?

Who are your peers and how are you collaborating with them?

____________________________________________________________

Polling is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments.