Procure-to-Pay Optimization – Are We There Yet?

There is no doubt that the technology exists to design a seamless, and paperless, Procure-to-Pay process within any organization. Once designed, the term “herding cats” comes to mind when describing the challenge of fine-tuning the roles and responsibilities of people within the Procure-to-Pay process. However, when the roles of people within the process are well defined and the technology is intuitive, optimization, and all the benefits that come with it, is within reach.

A few recent collaborations within the Peeriosity Accounts Payable research area highlight some of the challenges of optimizing even the most efficiently designed process enabled by enterprise technology such as SAP.

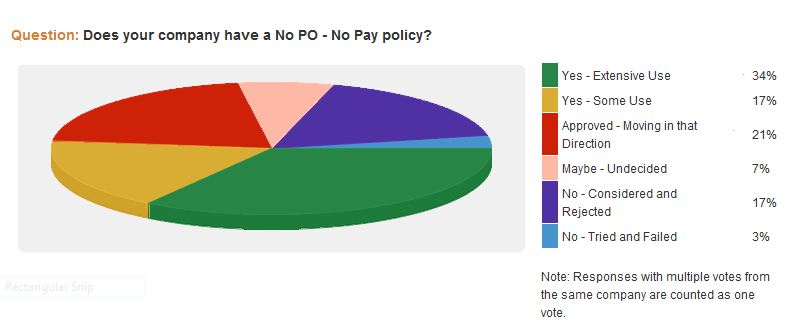

A Peeriosity iPolling question from a member company kicked off quite a discussion. The question….”Does your company have a No Purchase Order (PO) – No Pay Policy?” The results indicated that 51% have such a policy in extensive or some use, and another 21% are moving in that direction.

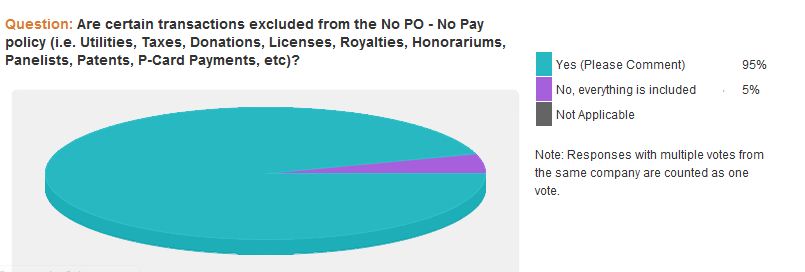

However, the follow-up question asked about exceptions to “No PO – No Pay” and 95% of respondents answered that there were exceptions, suggesting that the policy may be more of a guideline. Regardless of policy or guidelines, the process encounters invoices that require follow-up or handling outside of the desired process where a PO is present.

This Peeriosity iPolling question generated an exceptional number of comments, primarily around exceptions to “No PO – No Pay”. Most companies commented that they have an accepted list of expenditures that do not require a purchase order and include items such as utilities, taxes, charitable donations, and certain services being the ones most mentioned.

In even the most advanced companies, the reality is that exceptions arise and there will be invoices received that require a PO and do not have one, as well as invoices that are missing appropriate approvals. A recent collaborative webcast, also within the Peeriosity Accounts Payable research area, featured a company that has taken on the challenge of optimizing its Procure-to-Pay process. On this webcast, they focused on how to handle exceptions as efficiently as possible while working simultaneously to find solutions to eliminate them.

As with all Peeriosity webcasts, a poll (targeted to members within the Accounts Payable research area) was taken to determine what practices are in place and what the challenges are. From the poll results, we can conclude that implementing electronic workflow is a best practice to quickly and efficiently address exceptions. 74% of respondents either have a workflow in place for Procure-to-Pay or are currently implementing it. The remaining responses were either evaluating or implementing and there was not an instance noted where electronic workflow was rejected or failed.

The second poll question got to the heart of one of the issues that sub-optimizes this process. The results indicate that too many invoices are still reaching Accounts Payable without proper approvals or the approvals are not received in a timely manner.

Our webcast feature company had much larger issues at the outset of their journey than just tracking down PO approvers. Their entire process was fragmented; payments were processed in multiple locations and almost 40% of exceptions required manual handling and follow-up. They took on the major challenge to optimize the entire process. One of the first steps was to assign responsibility to the Shared Services organization and the end-to-end process would be enabled using their SAP platform.

To address the issues of missing approvals and timeliness, the Shared Services organization worked to define roles and responsibilities within the operations, as well as design the workflow to reach these roles. The focus was on making it easy and intuitive for those outside of Shared Services who would be receiving workflow messages.

Exceptions are now fully automated using the following process:

- Approver receives an e-mail notification: “You have an invoice to review”

- Click the link in the e-mail to SAP Portal

- Select invoice(s)

- Review invoice (displaying a scanned image)

- Approve, Correct or Reject, Reroute Invoice (add comments or special handling if necessary)

Users can customize their screens, as well as identify authorized persons as substitute approvers. The cycle time for review/response is expected to be one day.

The discussion continued and the participants agreed that effective workflow is a necessity within the process, however efforts to minimize the need for the workflow in the first place is a major part of the optimization process. Our feature company has realized exceptional results in their efforts, including;

- 100% of invoices are processed within Shared Services (scanned locally)

- All exception processing is handled via workflow and completely documented

- The end-to-end process is now standardized

- Centralized vendor master file management

- Payment terms are more easily managed

- Visibility of all payables

- KPIs for Shared Services, as well as functions and operations

- Improved information for vendor management and consolidation

- Efficiency has increased by over 50%

- Controls have improved

- Customers appreciate and like the process

As with any process that is on the road to optimization, it creates opportunities for Shared Services. Whether it be implementing policies such as “No PO – No Pay” with a clear set of exceptions (and working on solutions to those exceptions) coupled with workflow technology to quickly resolve exceptions, it is an iterative process of acting and reacting, measuring improvement along the way. In the end, value can be created by having a seamless cost-efficient flow of transactions and information with limited exceptions (and paper) that require manual intervention.

As one of our members stated, “Every time we touch a transaction it’s a defect we can ultimately fix. We’d rather spend our resources optimizing processes and eliminating work that can be automated rather than getting efficient at inherently inefficient processes.”

How is your Shared Services organization leading and transforming your company’s end-to-end processes?

Who are your peers and how are you collaborating with them?