A Panel of Corporate Card Experts Discuss their T&E and Purchasing Card Programs

Introduction

This report highlights a discussion among panelists from four companies regarding their Travel & Expense (T&E) and Procurement Card (P-Card) processes. The key topics discussed include card products used, software for expense reporting, number of cardholders, transaction volumes, filing frequencies, approval processes, risks, challenges, and potential areas for improvement. The panelists shared insights into their T&E processes, highlighting the importance of proper approvals, addressing inappropriate card usage, managing receipt requirements, and leveraging technology for auditing and fraud detection. Regarding P-Cards, they discussed strategies for preventing duplicate payments, addressing gift card purchases, and exploring virtual card solutions. Several panelists mentioned exploring artificial intelligence (AI) and machine learning capabilities to enhance auditing, fraud detection, and process optimization. Overall, the discussion focused on balancing controls, compliance, and efficiency while addressing common challenges in T&E and P-Card management.

Company Experience

The panelists provided an overview of their respective companies’ T&E processes, including details on card products used, expense reporting software, number of cardholders, transaction volumes, and filing frequencies. Key points included: – Company A: 5,000 cardholders, using Concur for expense reporting, filing by statement period or trip, aiming for no more than two submissions per month. – Company B: 5,000 cards, using Oracle for expense reports, 11,000 reports per month, filed by trip or monthly. – Company C: 3,000 cards, using Infor, 4,200 reports per month, filed at least monthly but no more than weekly. – Company D: 6,000-7,500 cardholders, using Concur Expense and Request, 8,000 reports per month, predominantly trip-based reporting.

The panelists discussed various challenges and areas for improvement in their T&E processes, including: – Ensuring proper approvals and addressing inappropriate card usage through training, communication, and disciplinary actions. – Managing receipt requirements, addressing missing or unreadable receipts, and exploring receipt thresholds or affidavit usage. – Leveraging technology and artificial intelligence (AI) for auditing, fraud detection, and process optimization. – Addressing card fraud, such as compromised card numbers or unauthorized cash withdrawals. – Balancing controls and compliance with efficiency and cost considerations, such as software pricing models based on transaction volumes.

The panelists shared insights into their respective companies’ P-Card processes, including: – Company D: Around 1,500-1,700 P-Cards, $14 million spend, using a company-built statement process with one report per month tied to the statement cut date. – Company C: 3,000 cards, $150 million annual spend, using Infor, filed at least monthly but no more than weekly. – Company B: Over 1,000 cards, 3,000 transactions per month, using Bank of America Works system for allocation and receipt retention. – Company A: 4,500-5,000 P-Cards, using JPMorgan’s PaymentNet system, reconciled monthly, import into GL, around $40 million annual spend.

The panelists discussed various challenges and areas for improvement in their P-Card processes, including: – Preventing duplicate payments for inventory purchases made with P-Cards and invoiced through regular channels. – Addressing gift card purchases made with P-Cards, which require payroll reporting. – Exploring virtual card solutions to reduce physical card usage and improve compliance through upfront approvals and coding. – Leveraging technology and artificial intelligence (AI) for auditing, fraud detection, and process optimization. – Balancing rebates and working capital considerations with control and compliance requirements.

Key insights and lessons learned:

- Provide targeted training and communication to cardholders and approvers on proper card usage, receipt requirements, and approval responsibilities.

- Explore implementing disciplinary actions for repeated non-compliance or inappropriate card usage.

- Investigate artificial intelligence (AI) and machine learning capabilities for auditing, fraud detection, and process optimization in T&E and P-Card programs.

- Review receipt thresholds and affidavit usage policies to ensure adequate documentation and transparency.

- Analyze opportunities for virtual card solutions to improve compliance and reduce physical card usage in P-Card programs.

- Evaluate software pricing models and transaction volume impacts to optimize cost-effectiveness.

- Enhance reporting and data analysis capabilities to identify potential duplicate payments, fraud patterns, and areas for process improvement.

- Collaborate with vendors and suppliers to establish clear guidelines for P-Card usage and invoice submission to prevent duplicate payments.

- Assess working capital strategies, such as extended payment terms, to leverage virtual card adoption and rebate opportunities.

- Continuously review and update policies and procedures to address emerging risks and challenges in T&E and P-Card management.

Polling Results Review

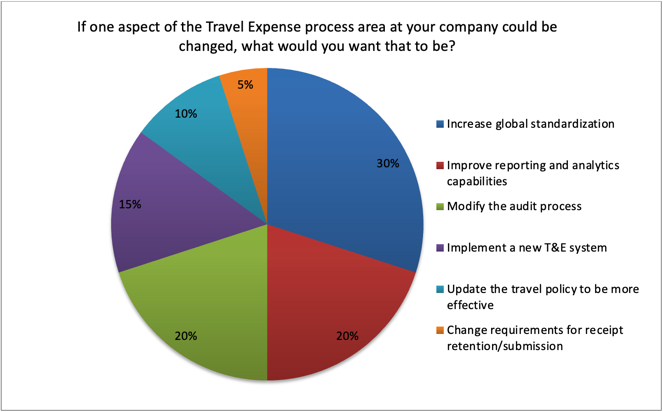

A Peeriosity-100 poll provides insight to opportunities in T&E and Pcard. The first poll question asked about the biggest improvement opportunity in T&E. 30% of Peeriosity-100 members cited increasing global standardization. 20% cited improvements in reporting and analytics capabilities, 20% cited modifying the audit process, 15% cited implementing a new T&E system, the balance of 15% selected either updating the travel policy to increase its effectiveness, or changing requirements for receipt retention/submission.

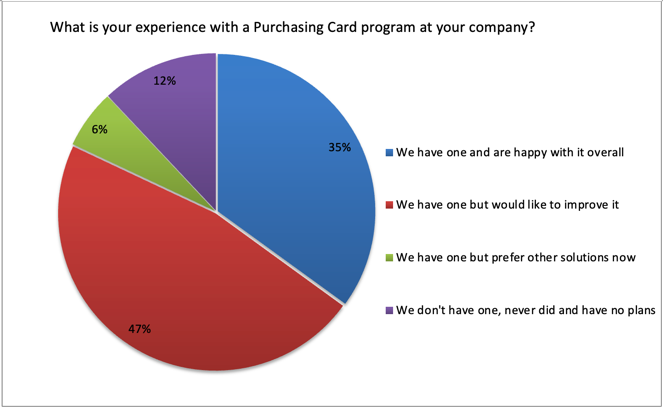

The second poll looked at member company experience with Purchasing Cards. 35% of member companies are happy with their Purchasing Card programs, and 47% have a program but would like to make improvements. The balance of 18% either have other options they now prefer, or the have no plans to implement a Purchasing Card program.

Following are some of the Peeriosity-100 member comments related to this poll:

- Currently our Purchasing Card program is just for North America and we spend about $9 million on it, which is not bad, but also not really all that much for our size. It seems to be robustly used by some groups and others almost not at all. In the past we have worked with indirect procurement to expand its usage but with only a moderate amount of success.

- We have a Purchasing Card in conjunction with our Virtual Card, both managed by Citibank. We are actively increasing the use of both and have had success with them.

- Our Purchasing Card program is at a mature level already so there is not a high level of activity to increase our spend, but rather looking to coordinate our spend with key suppliers.

- The reason why the emphasis is low is because we are migrating payments to Virtual Card and front-end approvals for spend going through R2P technology and reducing physical plastic in the field.

- We have a Purchasing Card process but are working on solidifying policies and procedures around its use.

- We would like to modernize and automate as much as possible the process of submitting and auditing purchase card expense reports.

- Moving away from Purchasing Cards.

Closing Summary

Most Peeriosity-100 Peercasts feature either a single company or a panel of companies discussing one specific issue or opportunity. A new and successful addition to Peercasts has been to add panel discussions with peer experts in a process area responding to a wide range of issues, giving Peeriosity-100 members the opportunity to go deep into the details. For every process there are often multiple process design options, technologies, and vendors available. Understanding the right approach for your company can be a much easier process when you can learn directly from the experience of peers.

What is the design of your T&E and Procurement Card processes? Is your current approach meeting your needs or are their changes that should be considered?

Who are your peers and how are you collaborating with them?

____________________________________________________________________________

Peercasts are private, professionally facilitated webcasts that feature leading member company experiences on specific topics as a catalyst for broader discussion. Access is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from attending or accessing discussion content. Members can see who is registered to attend in advance, with discussion recordings, supporting polls, and presentation materials online and available whenever convenient for the member. Using Peeriosity-100’s integrated email system, Peer Mail, attendees can easily communicate at any time with other attending peers by selecting them from the list of registered attendees.

Polling is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity-100’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in Polling.