The Many Ways to Update Vendor Master Data for Banking Information

Introduction

One of the most complex parts of Master Data Management is controlling the process for making changes and updates to Master Data records. One example of where this is particularly important is in the process followed to create or update vendor bank account information. Unfortunately, this is a process that all too frequently includes fraudulent requests for account changes where imposters are attempting to steal payments.

Many different processes have been common over the years, including requiring a copy of the account information on bank letter head, performing a penny test where a small amount is sent and receipt of that amount is verified by the vendor, and the direct approach of calling the vendor number recorded in the Vendor database to confirm the banking information via a phone call. In addition, there are variety of companies who claim to be able to complete this process accurately including DECENTRO (using penny-drop verification), Finicity, GIACT, LexisNexis, Orum, PaymentKnox, Paymentworks, Plaid, Tink Trustpair, Todlee, with other options likely to be available.

Polling Results Review

Peeriosity-100 Polling was used by the Director of Strategic Initiatives at member company to understand the approaches followed by member companies to verify vendor bank account information. Responses were posted real-time, with visibility to company responses available to all Peeriosity members, allowing for direct communication with peers using Peeriosity’s integrated Peer Mail capabilities. Using this approach, the poll author was able to quickly gain insights to his issue, which he described as follows:

One area of potential fraud in AP is making ACH payments. We are interested in finding out what other companies are doing to ensure that the bank account they are using in fact belongs to the intended vendor and is not a fraudulent account. Information about vendors and/or in-house processes you are using to help with this, and how those are working for you is appreciated.

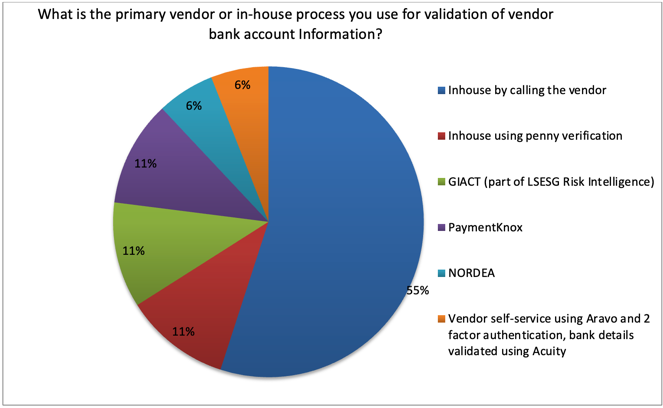

The first polling question asked about the primary vendor or in-house process used to validate vendor bank account information. Most companies, at 55%, perform the process inhouse by calling the vendor, and an additional 11% perform the process inhouse by using penny verification. The balance of 34% of the companies use 3rd party solutions, with one company who has integrated the solution into their vendor portal. Here are the details:

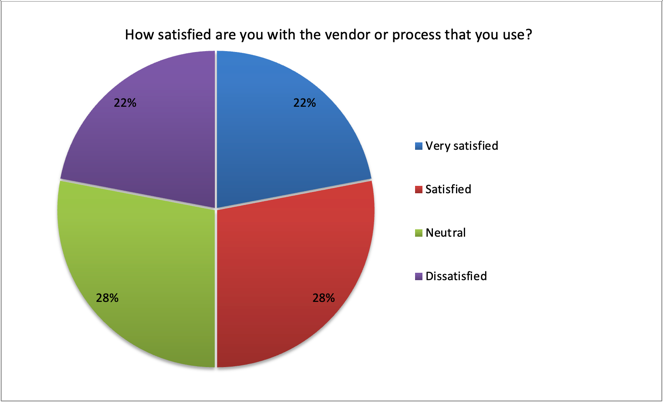

The second poll question asked about the level of satisfaction companies have with the process that is used. While 50% reported they were either very satisfied or satisfied, 28% reported their level of satisfaction was neutral, with the balance of 22% reporting they were dissatisfied.

Here are some comments from responding companies:

- Use GIACT, but concerns that when it is not 100% sure it doesn’t always give a positive or negative response. Should always be a no if not 100% sure of validation.

- We are currently working on sourcing a third-party provider for this activity as it is a very time intensive activity. Very interested in seeing what other companies are using.

- We are satisfied that calling the suppliers using the number in our ERP system works. We have caught many fraud attempts. However, the amount of time it takes to make the calls and speak with a person to get the validation is extremely inefficient.

- Procurement will have a conversation with the Vendor and initiate the update. A second validation occurs by a different group within the Organization.

- We use inhouse validation with phone verification. We are dissatisfied with our current controls and processes and are working on optimizing them currently. We are also actively assessing software to implement to help strengthen our controls.

- We seek to take ownership of the process hence we are calling vendors to validate bank details having been burnt in the past by bogus letters telling us their bank details.

- We are using NORDEA solution, but we have a low response rate when it comes to US Banks confirmation.

- Bank account can only be updated by the vendor using their credentials and identity authenticated via a SAAS system (Aravo), which has two factor authentication. Bank details are validated via a software, Accuity, whether details (bank key swift) are correct. For top 20% of vendors, we request approval from supplier’s buyer/sponsor. The rest we send notification to identified buyer/sponsor on the bank account change.

Closing Summary

For many problems and issues where companies don’t have direct experience with solutions they are considering, knowing the approach taken by peers, and having an idea of the results that can be expected, can be valuable so that you can make informed decisions as the basis for process design changes. While differences will exist between companies, having first-hand knowledge of the experience of leading peer can be an excellent guide, in addition to being a valuable starting point.

For the process of updating vendor bank account information, the traditional approach of calling the vendor to verify remains the most common method, consistent with how bank accounts have been verified for decades. As suggested by this research, many companies are not satisfied with the results, and with new types of verification services now available, there are likely more efficient methods with a higher degree of accuracy available, at a lower total cost.

How does you company update vendor bank account information? When was the last time this process was reviewed and updated?

Who are your peers and how are you collaborating with them?

______________________________________________________________________________

Polling is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity-100’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in Polling.