Corporate Card Liability and Payment Practices

Introduction

When designing your Corporate Travel program, in addition to selecting software for processing travel expenses and the preferred card product for employees to use when traveling, you also need to decide whether the company or the employee has card liability, and which party makes payment to the credit card company.

Implementing or modifying a Corporate Travel program design is often driven by advice and coaching for consultants, and/or vendors who have a card product they are promoting. While advice from parties interested in selling you a service can be valuable, having direct insight to the design choices of your Peers is a better approach, to the extent that getting this information can be accomplished with minimal effort.

Fortunately, for Peeriosity-100 members, it’s easy to draft a Polling question and quickly learn how other members tackle the problem, with the ability to directly follow up with other participants for further discussion and dialogue. With Peeriosity-100, your poll will go to hundreds of members for possible response, with those that have knowledge providing inputs that are likely to be directly on point to solving your issue, all at no cost to you. Plus, the exchange is completely private, with only members whose companies provided an answer to the poll questions able to access the detailed results and findings.

Polling Results Review

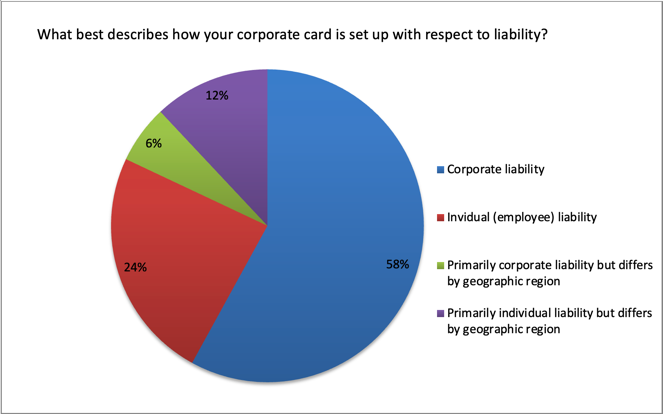

Polling was used to provide insight to the practices followed by Peeriosity-100 members regarding credit card liability and responsibility for payment. To the question of liability, at 58% of member companies the company has the liability and not the employee, and at 24% of member companies liability resides with the employee. For the remaining 18% there are differences based on the requirements of different geographic regions. Here are the details:

Below is an analysis of this issue from Corporate Card Process Experts at Peeriosity-100 who were asked to comment on this topic:

- Except for one country, our Corporate Card programs are corporate liable. Corporate liability allows companies to control their speed of pay, that often equates to increased rebates. It also prevents individual cardholders from incurring late fees, which at times are outside of their control.

- Corporate liability. Individual liability would increase the timeliness of the completion of expense reports, because being late impacts the individual’s credit score. However, corporate liability allows us to protect our associate’s personal information as well as provides options to associates who otherwise would not be able to obtain a credit card for business purposes.

- Here is a summary of pros and cons for both corporate liability and individual liability.

- The pros for individual liability:

- The business is not liable for unauthorized charges, and charges are not recorded into the books unless approved in the expense reporting process.

- Increased compliance comes from the organization’s ability to deny payment for unapproved corporate card charges. When a charge is not approved it must be paid by the employee or they would face delinquency on an account in their name.

- Incidental use of the corporate card for personal expenses is easily resolved in the expense reporting process by pushing responsibility for the payment of these personal charges to the employee.

- The cons for individual liability:

- The business is relying on the credit of the individual employee and is making them responsible for reimbursable business-related transactions. In some cases, employees may not have enough credit to qualify for a credit card.

- Even though the employee may be liable, businesses generally remit payment for approved expenses to the bank on the employee’s behalf. This process tends to be automated and when it fails it can create late payments, late fees and ultimately impact the credit of employees.

- The pros for corporate liability:

- Corporate liability is the easiest way to get credit into the hands of the traveling employees.

- Managing payment terms and benefiting from making the latest possible payment is easier when a single payment made.

- No credit scoring or credit availability is required by employees as the business is the debtor.

- The cons for corporate liability:

- The business will be responsible for non-business-related expenses if they cannot recover these expenses from the employee.

- The pros for individual liability:

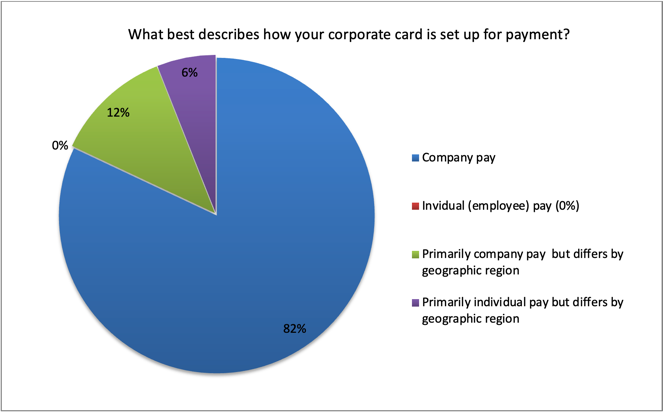

The second poll question looked at how the corporate card was set up for payment. Here the results were even more shifted towards company responsibility with 82% indicating company pay and an additional 12% indicating a preference for company pay with differences are required by geographic region. Only 6% reported a preference for individual pay.

Below is an analysis of this issue from Corporate Card Process Experts at Peeriosity-100 who were asked to comment on this topic:

- With Company Pay, there is centralized accountability for payment of the corporate card expense bill to the card provider. More visibility and control for the liability to the corporate card provider. A 100% receipt and business purpose audits are completed for all expenditures. A reconciliation is completed on the back end to identify expenses that have not been reconciled in the expense reporting system with repercussions (card inactivation) if not reconciled. Data is available immediately for accrual purposes.

- Our business covers entities in over 65 countries. In all countries we pay the corporate card transaction to the bank on behalf of our employees. However, there are countries where the card provider does not offer shared liability, so the liability is with the employee.

Closing Summary

When designing your Corporate Travel program, decisions for who is liable for the credit card charges and who makes the payment for credit card charges is an important consideration. Based on research with Peeriosity-100 member companies there are a number of compelling reasons why company liability and company pay may be the best options.

How does your company find out how leading peer companies are resolving the same challenges you are facing? And specifically, how have you designed your Corporate Travel program with regards to credit card liability and payment responsibility?

Who are your peers and how are you collaborating with them?

___________________________________________________________________

Polling is available exclusively to Peeriosity-100 member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity-100’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in Polling.