Invoice Errors – Do You Block and Research? Reject? Short-Pay?

Introduction

Every process within the scope of Global Business Services has hundreds of detail process steps and procedures that often evolve over time, without close inspection to see if each process is truly optimized. One example of a detailed process with design variations between companies is the process followed in Accounts Payable (P2P) for when an invoice that is received either electronically or by paper has incorrect or unauthorized charges. How are these invoices handled? Are they rejected and sent back to the vendor for correction? Is best practice to block these invoices until the issue can be research and resolved? If they are blocked, what organization in the company has ownership? Does it ever make sense to deduct incorrect or unauthorized charges and simply short pay the invoice?

Fortunately, for Peeriosity-100 members, it’s easy to draft a Polling question and instantly learn how other members tackle the problem, with the ability to directly follow up with other participants for further discussion and dialogue. With Peeriosity-100, your poll will go to hundreds of members for possible response, with those that have knowledge providing inputs that are likely to be directly on point to solving your issue, all at no cost to you. Plus, the exchange is completely private, with only members whose companies provided an answer to the poll questions able to access the detailed results and findings.

Polling Results Review

At Peeriosity-100 members can quickly get insights from other members, with the ability to follow up directly with the people who respond to get more information, or to continue the discussion. Recently the Global Trade Payables Leader at a member company wanted to better understand options related to this topic. As she explained, “We have vendors who invoice incorrectly or not in line with the purchase order as they may include surcharges or freight. We also have vendors that charge tax when we should be tax exempt. Currently we block or reject invoices and wait until a corrected invoice is received or if the extra charges are approved by the business approver, the invoice is paid in full. We are wondering how other companies handle these situations and if it is common practice to short pay invoices.”

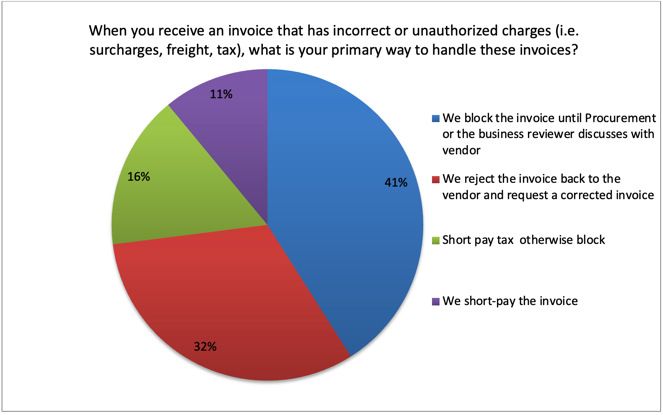

The first poll question asked, “When you receive an invoice that has incorrect or unauthorized charges (i.e., surcharges, freight, tax) what is your primary way to handle these invoices?” The most popular answer, at 41% of responding Peeriosty-100 member companies, is to block the invoice until Procurement or the business reviewer discusses with the vendor. An additional 32% of companies reject the invoice back to the vendor and request a corrected invoice. Finally, 16% short pay if the issue is a tax charge that isn’t appropriate and otherwise block the invoice, and 11% short pay the invoice in most circumstances. Here are the details:

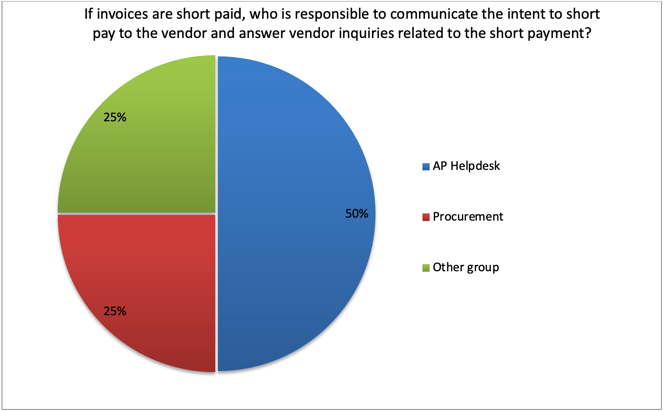

The second poll question drilled down into the issue for how the short pay invoices were communicated with vendor and who was responsible to answer vendor inquires related to short-payments, for companies who were using the short-pay approach. For 50% of companies, communication and responding to inquiries was the responsibility of the AP Helpdesk. The balance of 50% was evenly split between Procurement and another group having responsibility for communication and responding to inquiries.

Here are some of the comments from Peeriosity-100 members:

- Invoice blocked until reviewed with the vendor by Procurement or the business reviewer.

- We deduct for variances if Inv price exceeds PO, any quantity variances (damages/shorts) and any unauthorized charges. These show up on our portal for the vendor to review and that serves as our communication to the supplier.

- This will vary from country to country, but we don’t short pay anywhere. US if the charges are incorrect, we send them back. Everywhere else globally we require a credit note. In the US we only short pay if it relates to withholding taxes.

- We do not short pay invoices. We require a credit and we do not process the invoice until the correcting credit is received.

- Our expectation is suppliers submit their invoices with accurate information and we reject invoices in our eInvoicing portal if they don’t contain correct data, provided we catch the error up front. If we do “short pay” the supplier is welcome to email our support desk for further research.

- We short pay with a debit memo which is emailed to the contact on file. Questions or disputes of our debit memos go to our customer service/supplier support team.

- If the extra charge is freight, then we will pay it. If we are charged sales tax and it should not be charged, then we short pay the invoice with a note explaining why it was short paid. If the vendor has questions about the payment, then they are referred to the department that was sent the bill.

- We only short pay tax. If there another issue, we block until resolved. We do not let the vendor know we are short paying. If they call, AP will review.

- We short pay tax. For other charges such as freight, initially our invoices are blocked, payment hold if over a certain amount. If determined we do not wish to pay, we short pay. We have a Customer Service team who handles the majority of our inquiries from our suppliers. We also have a small team who oversee statement reconciliation for a small group of our top suppliers. These teams work with purchase order writers on validity of charge.

- AP does not short pay until the charges are reviewed by the buyer. Only once the buyer instructs to short pay, then AP performs the short payment. The expectation is that the buyer has informed the vendor of the same. Additionally, our remittance advise also notes a short description to let vendor know the invoice was short paid.

Closing Summary

There are many different approaches companies can take to almost any work process, and handling invoices amount errors is not an exception. Fortunately, for Peeriosity-100 member companies, it is very easy get help creating a poll where knowledgeable peers can respond, often within few hours, with responses and comments. And, since consultants and vendors are not eligible for membership, answers are candid and honest, without any bias, and with no one following up later try and sell you something you most likely don’t need.

How does your company find out how leading peer companies are resolving the same challenges you are facing? And specifically, what is the process you follow to resolved vendor invoice discrepancies?

Who are your peers and how are you collaborating with them?

_____________________________________________________________________________________________

“iPolling” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in iPolling.

Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here.