Global OTC Process – Right Work in the Right Place

The Order-to-Cash (“OTC”) process can be the most sensitive when it comes to addressing globalization or even in-country standardization for that matter. Direct interaction with external customers, for a number of plausible reasons, is generally thought best handled as a local relationship value builder.

However, more and more organizations are looking deeper and challenging the “closest to the customer” assumption and broadening the definition of value creation within the OTC process by:

- Standardizing the activities

- Classifying groups of activities into segments

- Identifying the value creation in each segment of work

- Define roles associated with activities in each segment

- Choose “Right Work and Right Place” for the role

A recent collaborative webcast in the Peeriosity Accounts Receivable research area featured an organization that chose to take this journey to optimize its OTC processes globally. On the webcast, they discussed the project and, in particular, how they went ahead with the standardization and classification of work segments, as well as the objectives of the overall strategy. These objectives included improved competitive advantage, order and service enablement, and reduced costs.

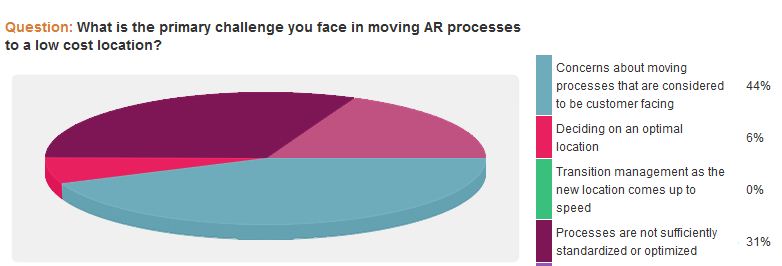

The discussion turned its focus to the transactional work segment and the opportunity of moving to an off-shore or lower-cost location. A Peeriosity poll of members indicated that only a relatively small percentage, 20% of members, have implemented a transition of the Accounts Receivable function to a lower-cost region. The follow-up question was very revealing and indicated that the major barriers that exist in organizations relate to standardization (31%) and concerns about moving customer-facing activities (44%).

The poll also led to some interesting discussion points from the “other” response which made up 19% of the results. One, in particular, indicated that after standardizing the process, they were able to keep much of the work within the US, but achieved a great deal of the cost reduction through innovative working arrangements, including a flexible mobile workforce.

For those organizations with a global presence and great opportunity, sourcing evaluations tend to include all the combinations of on or off-shore locations, as well as captive or outsourced resources. Our feature company started with a “clean slate” that ignored all of the preconceived notions (language and cultural barriers, time zones, control) and was completely fact-based and chose to pilot an offshore captive with (initially) minimal external customer interaction.

It is important to note that our feature company was already world-class in terms of cost and productivity in the activities that were being piloted. The view was to prove the concept and, if successful, grow the offshore captive with greater OTC scope and depth. This is an important point, as many organizations may find resistance to trying to make a business case based on the initial ROI of already well-run activities. However, with global process ownership and vision, this was a step in what would be a much longer journey of value optimization.

The pilot was a great success in which the already efficient cash application in the US was shifted offshore. The project timeline to implementation was nine months, which included four months of staffing and training in the new location. Within 12 months of starting the project and within 3 months of go-live, 100% of US cash applications were offshore with all SLAs met or exceeded and with a 22% productivity gain which was not initially anticipated.

Some of the key success factors were:

- Comprehensive project plan

- Well-documented processes and process exceptions (and how they are handled)

- The exhaustive recruiting process to find experienced candidates

- Clear SLAs and line-of-site metrics

- Leveraged lockbox network providing electronic images and SAP interfaces

Lessons learned included:

- Experienced hires have a short learning curve and can improve processes

- While counter-intuitive, start with fewer resources than you anticipate needing (but have a contingency plan)

- Language is less of an issue than anticipated

- Company culture is more of an issue than anticipated

- With proper planning, time zone differences can work to your advantage

Our feature company was able to leverage the success of the offshore captive pilot and has since added both additional OTC activities such as Collections and Deduction Management and broadened the scope beyond their US operations to the rest of North America and Europe, all serviced from a common center and team. Additionally, by segmenting the OTC process and using the “Right Work, Right Place” strategy, they have optimized their entire OTC process globally, not only by globalizing some of the work but by localizing and improving other activities.

One of the overall lessons learned from the webcast was that while quantitative benchmarking is important, it should be considered just a data point in a broader discussion. Our feature company and others within the Peeriosity collaboration are “world-class” in cost and productivity. However, as the webcast and ongoing collaboration online point out, gaining insights from strategic initiatives directly from your peers can help guide your journey to not only keep your back-office cost-competitive but create value through optimization efforts that enable competitive advantage throughout the process.

How is your Shared Services organization transforming your company’s OTC process?

Who are your peers and how are you collaborating with them?