Introduction

While many companies have made significant improvements over the recent years to their Customer Cash Application Process, there often remain many opportunities to enhance this critical portion of the Order-to-Cash [1] organization.

This research abstract features the experiences of a Peeriosity member company that recently carried out a focused initiative to streamline this critical process, and what they shared regarding the challenges they faced and the benefits realized by their efforts in this key area.

Company Experience

A Peeriosity PeercastTM recently featured a global company with $15 billion USD in revenue and 50,000 employees. Their Cash Application function is part of the Credit Services tier in their Global Business Services operation, alongside Credit Risk Management [2], Billing, Dispute Management, Collections, Cash Flow Management, and Distributor Finance.

The project to improve the automation of the Cash Application process [3] had as objectives improving cash cycle time, widening general experience levels in the area of automation and robotics, investigating potential savings, and improving the Cash Application team’s engagement.

Their first phase of Market Research started in October 2017 and the project was completed in August 2018. Lessons learned included:

- Automation can be achieved in highly complex and “judgment intensive” processes

- The project manager’s role to link technology with business requirements is crucial

- The preparation phase requires significant time, and it’s important for detailed project scope needs to be defined upfront

- It is critical to define risks and incorporate control & checkpoints

Other project details included on the Peeriosity member website as part of this presentation include a high-level process map and project deliverables.

iPollingTM Results Review

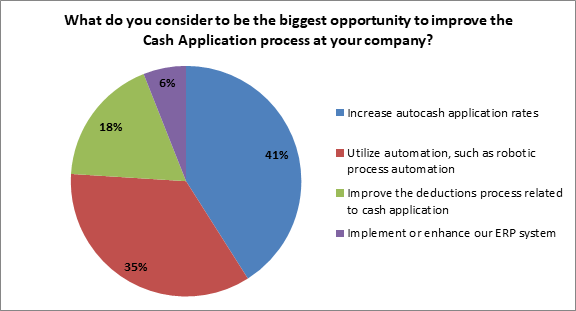

A Peeriosity poll created using the iPollingTM technology was created in conjunction with this PeercastTM and provides some interesting insights related to the Cash Application process. The first of two poll questions asked what members consider to be the biggest opportunity to improve the Cash Application process at their company. Increasing AutoCash application rates was the most popular response (41%), followed by utilizing automation, such as robotic process automation, at 35%. Improving the deductions process as it relates to cash application was selected by 18% of the companies, and implementing or enhancing the ERP system was chosen by the remaining 6%.

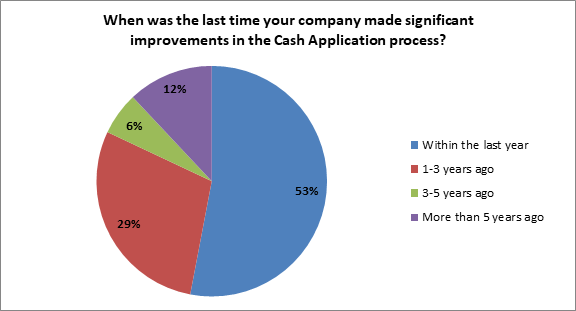

The second poll question then addressed when the last time their company made significant improvements in the Cash Application process. The majority of companies (53%) have done this within the last year, followed by 1-3 years ago at (29%), 3-5 years ago at 6%, and 12% selecting more than 5 years ago.

Some of the poll comments made by Peeriosity members related to this poll include the following:

Wholesale & Distribution Member: The cash processing is managed in-house and we are able to get a 94% payment match rate for paper checks. We are looking to use RPA or IA to improve our EFT/ACH payments match rate of 90% to 95+%.

Consumer Products & Services Member: We implemented High Radius Cash Application Automation (CAA) six months ago (May 2019). Our success rate is in the mid-80 %. We are working with customers whose payments are not auto-applied to improve our success rate.

Energy & Utilities Member: We implemented the High Radius Cash Application Automation tool one year ago. Our hit rate has improved for checks and electronic payments. Continual efforts to improve master data maintenance will help to improve the hit rate as well as work with our customers on remittance formatting.

Manufacturing Member: Since the implementation of AutoBank 3 years ago we have been able to reach best-in-class automation levels in our cash application process. The main challenge is currently represented by North American customer short payments which are still creating unnecessary burdens along the chain.

Consumer Products & Services Member: We implemented High Radius Intelligent Receivables about a year ago for Cash Application. Auto-applied cash averages around 90%. Our next focus area is on deduction automation. Looking at a couple of different tools, including High Radius Deduction Cloud.

Non-Profit Member: RPA would be a close second to the process improvement opportunities in our organization.

Healthcare, Pharmaceuticals, Biotech Member: Increase in Auto cash applications specifically for non-check formats is a priority across the globe.

Closing Summary

Because of the high customer payment volumes at most companies, the ability to make even a minor improvement in the Cash Application process can yield significant results. As was the case with our feature company, introducing additional automation can provide breakthrough results.

What is the status at your company regarding the overall efficiency of the Cash Application process [4]? Is your current approach providing the optimal results for this important process area?

Who are your peers and how are you collaborating with them?

______________________________________________________________________________

“PeercastsTM” are private, professionally facilitated webcasts that feature leading member company experiences on specific topics as a catalyst for broader discussion. Access is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from attending or accessing discussion content. Members can see who is registered to attend in advance, with discussion recordings, supporting polls, and presentation materials online and available whenever convenient for the member. Using Peeriosity’s integrated email system, Peer MailTM, attendees can easily communicate at any time with other attending peers by selecting them from the list of registered attendees.

“iPollingTM” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated email system, Peer MailTM, members can easily communicate at any time with others who participated in iPollingTM.

Peeriosity members are invited to log into www.peeriosity.com [5] to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here [6].