Introduction

Centralizing travel expense report processing as part of Shared Services requires a more sophisticated approach, with travelers and reviewing managers located hundreds, if not thousands, of miles away from the processing center. Yes, placing responsibility and accountability [1] with the department manager responsible for the expense is necessary, but that does not fully excuse Shared Services from fiduciary responsibilities to ensure adequate business controls including an audit process [2] to ensure compliance with company policies, and related legal and tax requirements.

iPollingTM Results Review

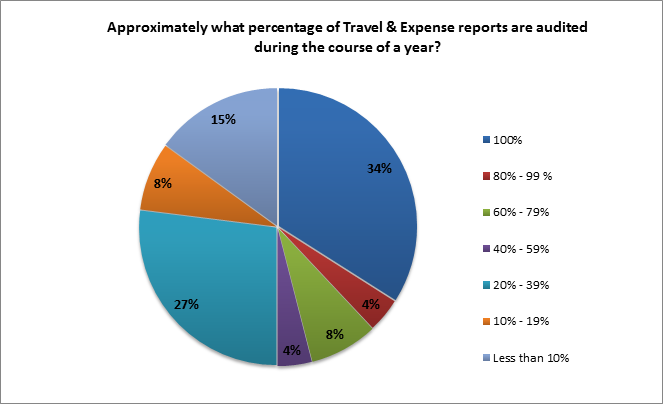

A Peeriosity poll was recently created using the iPollingTM technology to provide insight into the Travel & Expense [3] report audit process. The first poll question asked about the percentage of Travel & Expense reports that were audited on average over the course of a year. The results indicate that for 34% of member companies, 100% of expense reports are subject to audit, with an additional 16% auditing between 40% and 99%. Interestingly, the other 50% of member companies audit less than 40% of expense reports. Here are the details:

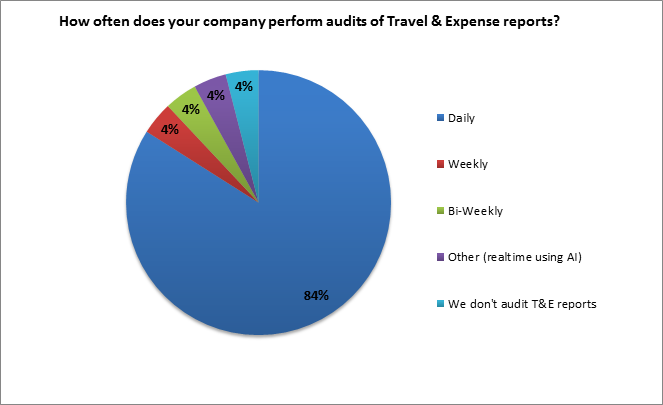

When asked about how often audits are performed for Travel & Expense reports [4], 84% are auditing on a daily basis, with 4% auditing real-time using an Artificial Intelligence application, 4% that don’t audit any reports, and the balance of 8% who audit either weekly or bi-weekly. Here are the details:

Here are a few of the comments from Peeriosity members:

- We have deployed an AI-based application that screens 100% of expense report lines as they are incurred. This application flags reports we have set parameters around as high-risk for a human review. This happens fairly in real-time as expense reports are submitted and before they are routed for additional approval.

- Our expense reporting tool Concur has over 50 rules in place that will trigger a flag for audit review if any exception is noted. Any expense report with such a flag will be reviewed. Additionally, a percentage of expense reports with no flags are sampled.

- We audit an average of 75% of expense reports annually which account for roughly 95% of travel-related expenses.

- Today, 100% of our expense reports are manually reviewed. We are currently evaluating AI software to review 100% of expense reports rather than the human touch.

- 25% random audit is conducted, plus by audit rule.

- We conduct pre-payment audits, as well as post-payment, and are in the process of implementing an AI-based application to audit 100% of expense reports.

Closing Summary

While there are various approaches used, and with differences in the frequency and the percentage Travel & Expense reports [5] reviewed, most member companies perform some type of expense report audit. What is caught in the audit process will vary and, although a of the level of misuse from honest mistakes or inattention to detail is probably more likely than intentional fraud, both are costly. Developing processes that consider risks and put into place appropriate controls is an important fiduciary duty for any Travel & Expense process. Fortunately, for Peeriosity members, it is easy to quickly compare current processes with the processes of leading peers, where all can benefit from candid discussions regarding what works well and what doesn’t.

What is your company’s approach to Travel & Expense report auditing? Are there opportunities to make changes, and are new tools now available to further improve the Travel & Expense report audit process?

Who are your peers and how are you collaborating with them?

“iPollingTM” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated email system, Peer MailTM, members can easily communicate at any time with others who participated in iPolling.

Peeriosity members are invited to log into www.peeriosity.com [6] to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here [7].