Utilizing Technology to Reduce Your Company’s Exposure to Corporate Card Fraud

Description: The risk of fraudulent transactions continues to limit the ability of companies to expand the distribution and allowable usage of both the PCard and the Travel card. However, new tactics and technologies have been developed that can help to mitigate these risks when implemented and administered properly. This Peercast will look at how companies are using these tools and what the benefits and challenges of doing so have been up to this point in time.

Peercast Poll Results

Poll Title: Utilizing Technology to Reduce Exposure to Corporate Card Fraud

Background: The risk of fraudulent transactions can limit the ability of companies to expand the distribution and allowable usage of both the PCard and the Travel card. However, new tactics and technologies have been developed that can help to mitigate these risks when implemented and administered properly.

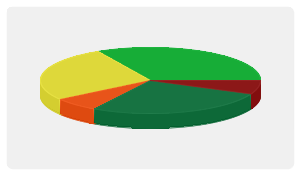

Poll Question: What is your company's primary solution/approach to identify fraud related to use of the Corporate Card?

| Concur Audits - Prepayment | 0% | |

| Concur Detect | 7% | |

| Oversight | 27% | |

| Forensic Auditors (in house, utilizing developed audit rules) | 7% | |

| Standard Internal Auditors | 27% | |

| Third Party Audit Firms | 0% | |

| Supervisor Review | 33% | |

| Other (please comment) | 0% |

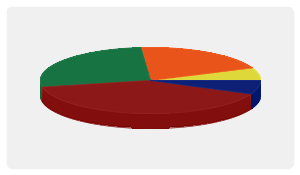

Poll Question: What best describes the use of technology at your company to reduce exposure to Corporate Card fraud?

| Technology is critical to reducing our exposure; we rely on it almost exclusively | 7% | |

| Technology is important to reducing our exposure; we use it along with other approaches | 40% | |

| Technology is helpful to reduce our exposure but we are most reliant on other approaches | 27% | |

| We use limited technology to help reduce exposure | 20% | |

| We do not utilize technology to reduce exposure | 7% |