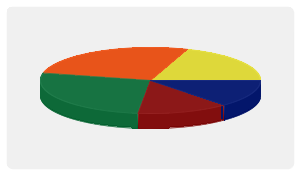

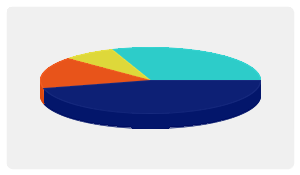

Poll Title: AP Recovery Audit - Distribution of Recovered Dollars

Background: Many companies contract with a 3rd party Accounts Payable (AP) Audit and Recovery firm and have several options available regarding how they can distribute any recovered amounts (typically less the contingency fee). This poll looks at the various distribution options and if the use of a materiality threshold is utilized in the distribution process.

Poll Question: Response that best describes where Accounts Payable audit recoveries are recorded at your company?

| |

Recoveries are recorded centrally (Corporate / Shared Services) |

13%

|

| |

Recoveries are recorded within the Accounts Payable Department |

13%

|

| |

Recoveries are recorded within the original Business Unit / Department at the detailed account level |

27%

|

| |

Recoveries are recorded within the original Business Unit / Department to a designated recovery account |

27%

|

| |

Combination of the above |

20%

|

| |

Other (Please Comment) |

0%

|

| |

Not Applicable |

|