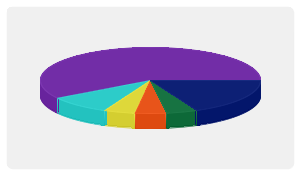

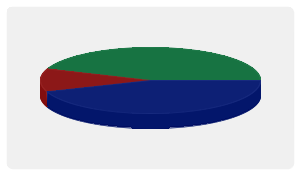

Poll Title: Charging Interest and/or Penalties for Past Due Trade Receivables

Background: This poll addresses trade receivable accounting policies related to past due accounts. Any comments you could add regarding such things as the criteria utilized to determine which accounts are charged interest or penalties, as well as what interest rate percentage is utilized, would be valuable additions to the poll results.

Poll Question: Does your company charge interest and/or penalties for past due trade receivables?

| |

Interest is charged per month consistently during past due periods |

18%

|

| |

Interest is charged per month with an escalating rate as time progresses |

0%

|

| |

Interest is only charged on select past due accounts |

5%

|

| |

Interest is charged on an ad hoc basis for significant past due accounts |

5%

|

| |

Interest is not charged, but a penalty is assessed |

5%

|

| |

Other (Please Comment) |

9%

|

| |

Our company does not charge interest and/or penalties on past due trade receivables |

59%

|