Poll Title: Check vs. EFT - Adjusting Payment Terms to be Float Neutral

Background: We are always looking to switch our suppliers from a payment method of check to EFT. It is cheaper and more efficient. However, if the terms remain the same the supplier will be getting the benefit of the float by receiving their funds sooner (working capital). Our policy has been to try to remain float neutral and would like to know what others do.

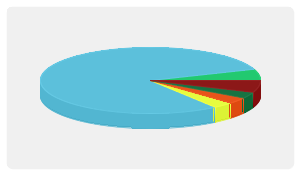

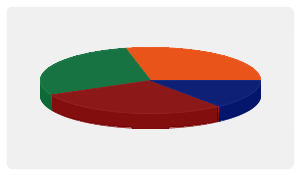

Poll Question: When switching a supplier from check to EFT, for how many extra days does your company hold the EFT payment to remain float neutral?

| |

1 Day |

0%

|

| |

2 Days |

6%

|

| |

3 Days |

3%

|

| |

4 Days |

3%

|

| |

5 Days |

3%

|

| |

We do not hold EFT payments for extra days |

79%

|

| |

Other (Please Comment) |

6%

|