Introduction

Shared Services work processes, like Accounts Payable (P2P) [1] have hundreds of detailed work steps and many required policy differences depending on the type of supplier, negotiated terms, industry standards, and legal or regulatory requirements. As companies work to implement the most efficient processes possible, understanding the details of how other peer companies handle similar situations can be very valuable.

Fortunately, for Peeriosity members, it’s easy to draft an iPollingTM question and instantly find out how other members tackle the problem, with the ability to directly follow up with other participants for further discussion and dialogue. With Peeriosity, your poll will go to hundreds of members for a possible response, with those that have knowledge providing inputs that are likely to be directly on point to solve your issue, all at no cost to you. Plus, the exchange is completely private, with only members whose companies provided an answer to the poll questions able to access the detailed results and findings.

iPollingTM Results Review

Recently a Peeriosity iPollingTM question was created to better understand the approach member companies take to paying invoices [2] with immediate payment terms [3]. Note that the assumption is that immediate payment is approved and appropriate, and not made simply because the invoice indicates “Net 0” or otherwise the payment is required upon invoice receipt. Even so, when approved and appropriate, “immediate payment” obviously suggests quickly, but likely doesn’t often meet the requirements to drop everything and process a wire transfer with the bank or create an on-demand check for manual signature. So, in other words, if it’s not “right now” what does “immediate payment” really mean?

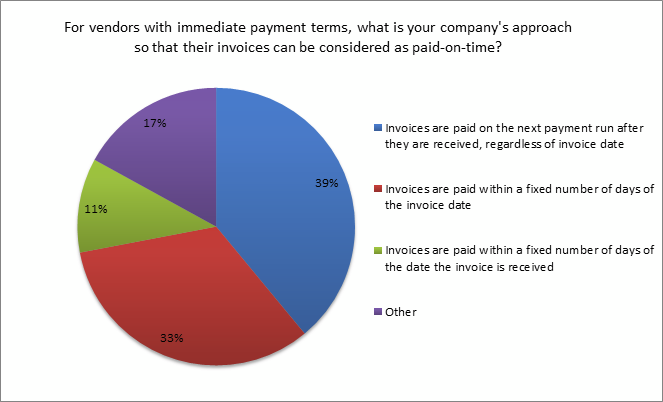

Based on the approach taken by 39% of Peeriosity member companies, “immediate payment” is to make the payment on the next payment run after the invoice is received and processed, regardless of the invoice date. An additional 44% make the payment within a fixed number of days, with 33% basing the number of days on the invoice date, and 11% basing the number of days on the date the invoice is received. The balance of 17% follows another process, which typically is one of the listed options, with the ability to make adjustments as required to meet business needs. Here are the details:

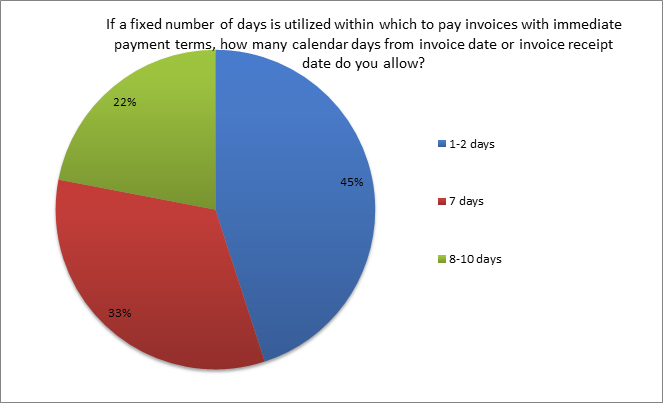

To further understand the responses, for companies who were in the category of paying based on a fixed number of days from either the invoice date or the date the invoice was received, the question was asked for insight into how many days would be typically allowed to be considered as paid-on-time. The differences here were significant, with 45% indicating 1 to 2 days, and the balance of 55% indicating anywhere from 7 to 10 days.

Here are some of the comments from responding companies that provide additional insight into the approaches member companies take to these types of transactions:

- Business-critical suppliers (Utilities/Rents) are paid as soon as possible after the required internal approvals have been completed. Most of the suppliers with immediate terms do not require Purchase Orders. For suppliers that utilize Purchase Orders, default payment terms are Net 30 unless otherwise negotiated in the agreement/contract and the negotiated terms are set by the Buyers when issuing the Purchase Orders.

- Invoices are paid within a fixed number of days of the invoice date (standard terms); however, we have a manual Prompt Payment process whereby our Purchasing associates can manually request a more immediate payment term if a valid business reason is provided.

- For most of our businesses, we do daily payment runs. Very rare to approve out-of-cycle requests when you’ve got daily payment runs!

- There should be no vendors with N000 terms unless business-critical. Business-critical (for example, utilities and taxes) are paid in the next payment run after being received. Currently, there is no approval on N000 terms so there are vendors set up with these terms that shouldn’t be. Invoices are physically impossible to go thru the AP process immediately especially if the 3WM requirements aren’t complete or other PO-related issues. We don’t pay vendors daily, so vendors with N000 terms may be paid after they have been designated as “due”.

- If payment terms are due immediately, the invoice will pay on the next scheduled payment run which is typically 1-2 days.

Closing Summary

Large multi-billion-dollar companies aren’t immune from the daily challenges and questions about how to fine-tune their processes to make them better. Many times, the issues are the same as those faced by companies with a smaller scale; however, for larger companies, because of the volume of transactions the impact of even a modest change can be significant. Being able to quickly identify the details of how leading peers approach similar challenges is a real advantage for making the types of changes that will create the greatest impact. This is certainly true when it comes to understanding different approaches for processing vendor invoices [4] with immediate payment terms.

How does your company handle vendors with immediate payment terms? When you dig below the surface, when is immediate payment required and what does it actually mean in terms of timing for when the payment is made?

Who are your peers and how are you collaborating with them?

______________________________________________________________________________

“iPollingTM” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility of all respondents and their comments. Using Peeriosity’s integrated email system, Peer MailTM, members can easily communicate at any time with others who participated in iPolling.

Peeriosity members are invited to log into www.peeriosity.com [5] to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here [6].